Gadget Financing in Nigeria: Buy Devices Now and Pay Small Small

Looking for Buy Now Pay Later for phones or gadgets in Nigeria? Discover the best gadget financing options to help you spread payments easily.

olamide a

No need to wait to upgrade your device learn how financing solutions in Nigeria help you get gadgets immediately and pay flexibly.

Why Gadget Financing Matters in Nigeria

Smartphones, laptops, and accessories are essential for work and daily life. But high costs and unstable income make lump sum payments difficult for many Nigerians. Financing helps bridge that gap.

What Is Gadget Financing?

Gadget financing, also known as BNPL (Buy Now, Pay Later), allows buyers to:

Get a device immediately

Pay in installments over weeks or months

Build credit history while using the gadget

Who Qualifies for BNPL in Nigeria?

Most financing platforms require:

Verified identity (BVN or NIN)

Stable income or student status

Valid contact details (email, phone)

Good credit record (if applicable)

Top Places to Access Gadget Financing in Nigeria

The most trusted platforms include:

360GadgetsAfrica (easy approvals)

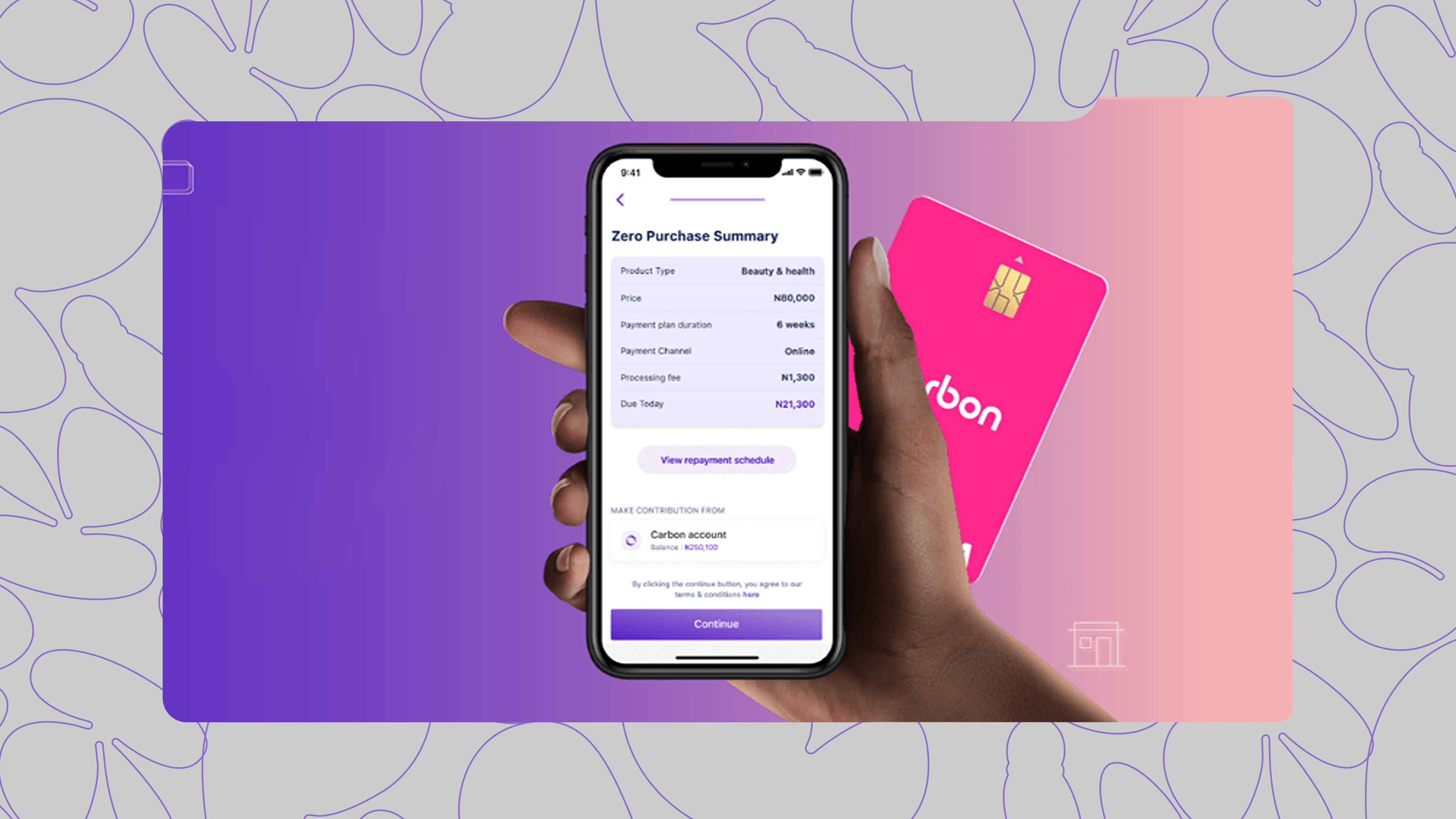

Carbon

CDcare

EasyBuy

Specta Credit

Ikigai

Required Documents to Apply

National ID, Voter’s Card or Driver’s License

Proof of income (pay slip or bank statement)

Guarantor (in some cases)

Residential address confirmation

Devices You Can Finance

iPhones and Samsung smartphones

Laptops and MacBooks

Tablets and iPads

Smartwatches and accessories

Gaming consoles and premium gadgets

Pros of Gadget Financing

Instant device access

Flexible repayment plans

Helps with work and education productivity

Cons to Keep in Mind

Higher overall cost if interest applies

Late payment penalties

Risk of repossession for default

Why 360GadgetsAfrica Is the Best Option

Fast approval and simple process

Low upfront payment required

Access to original devices only

Nationwide delivery

Dedicated customer support

Conclusion

Gadget financing is changing how Nigerians upgrade their tech. You can own the latest device today and pay in a way that fits your budget. If you want a trusted, flexible BNPL solution on genuine gadgets, 360GadgetsAfrica is your smartest choice.