How to Qualify for Gadget Installment Payment in Nigeria

Want to buy gadgets and pay later in Nigeria? Learn the requirements and fast approval tips.

Kolawole S.

Many Nigerians are eligible for credit but don’t know it. This guide shows the exact requirements and proven ways to get approved for gadget installment payments without stress.

Why Most People Get Rejected for BNPL

Many applications fail due to:

Incorrect or unverifiable personal details

Lack of credit footprint

Incomplete documents

Low or unstable income

Using unreachable phone numbers or emails

Understanding these issues helps you prepare better before applying.

Requirements for First Time Applicants

To qualify for installment payment in Nigeria, you typically need:

Valid government ID (NIN Slip, Voter's Card, or Driver’s License)

Verified phone number and active email

Proof of income (salary credit or business cash flow)

BVN for identity and credit check

Guarantor for some platforms

Optional but helpful:

Salary account statement (3–6 months)

Verified residential address

How Your Credit Score Affects Approval

The better your credit history, the higher your approval chances. Factors that affect your credit score include:

Timely repayment on loans or airtime credit

No record of unpaid debts

Long term use of verified bank accounts

Using financial apps with good rating history

If you are new to credit, you may qualify for lower limits first.

Best Ways to Increase Approval Chances

Apply during working hours for faster verification

Ensure all submitted documents match your BVN details

Avoid using multiple names across accounts

Pay utility and data bills through traceable platforms

Build small credit history with safe mini loans

These simple steps can boost approval in under 24 hours.

Common Mistakes to Avoid

Fake or altered documents

Claiming an income higher than reality

Providing inactive guarantor contacts

Applying across too many platforms at the same time

These can lead to automatic rejection or long-term blacklisting.

Where to Apply for Fast Approval

Some of the best platforms for quick gadget financing include:

360GadgetsAfrica (fastest approvals and flexible repayment)

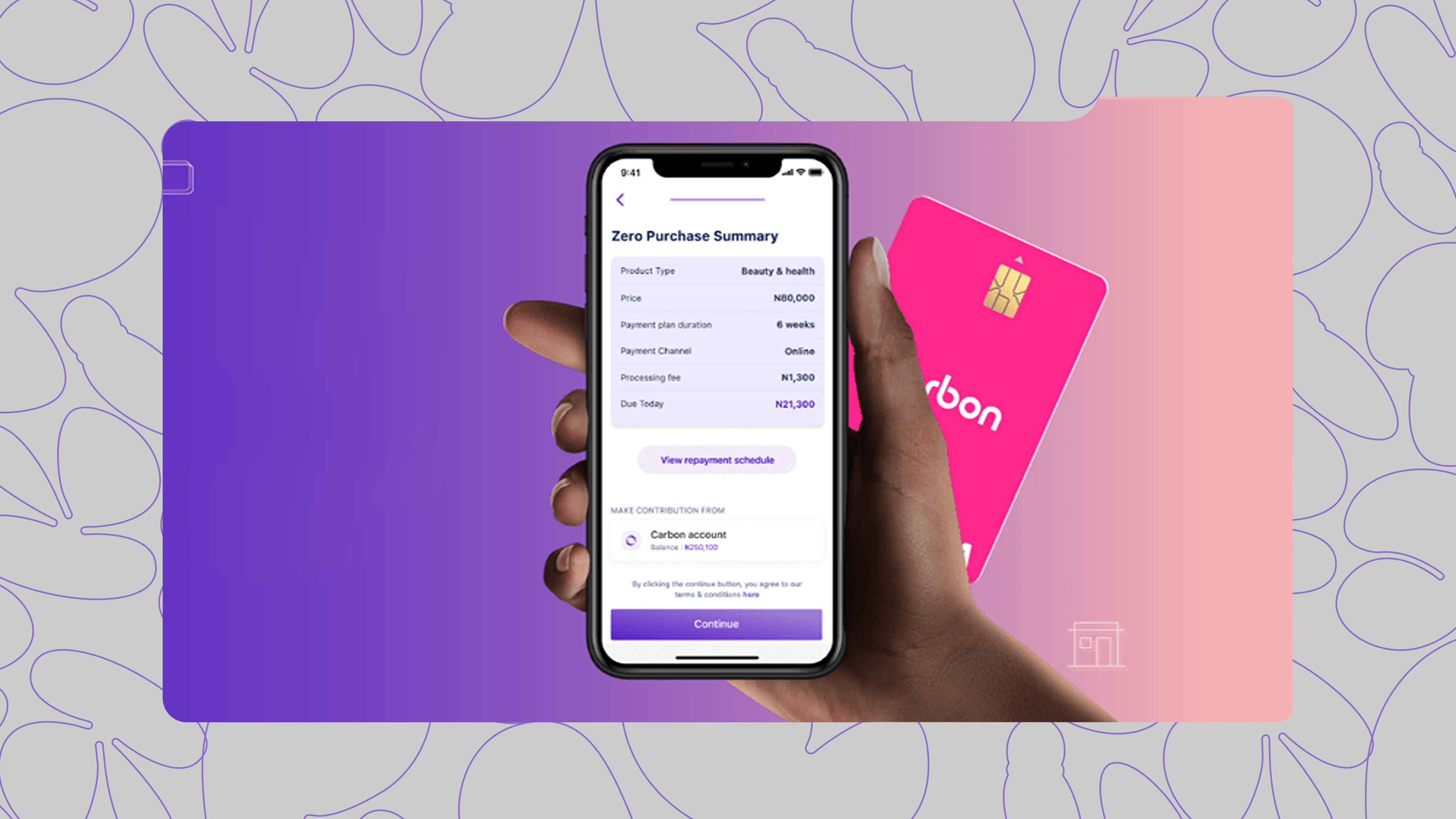

Carbon

EasyBuy

CDcare

Specta

360GadgetsAfrica is especially great for iPhones, Samsung, laptops, and premium accessories with nationwide delivery.

Final Take

Gadget installment payment makes owning quality devices easier, but eligibility depends on having the right documents and clean financial records. Follow these tips to boost your chances of getting approved quickly and enjoy your new device while paying small small.